About Us.

Welcome to Maharana Capital

MAHARANA CAPITAL SERVICES PRIVATE LIMITED is a type of company in the Indian non-banking finance sector, recognized under pursuant to subsection (2) of section 7 and sub section (1) of section 8 of the compnies act 2013 (18 of 2013) and Rule 18 of the compnies (Incorporation) Rules 2014 and this company is limited by shares.

MAHARANA CAPITAL’s core business is borrowing money/Investment from ours members and give them fix return Risk Free on monthly or yearly basis. we are regulated by Ministry of Corporate Affairs, which is also empowered to issue directions to them in matters relating to their deposit acceptance activities. However, in recognition of the fact that these companies deal with their shareholder-members only.

MAHARANA CAPITAL has been incorporated with the object of developing the habit of thrift and reserve funds among its members and also receiving deposits and investments from its members only for their benefit.

Invest for Secure The Future

“No Dream is too Big to INVEST FOR YOUR FUTURE GROWTH that can’t contained. Your Money is Our Responsibility. We are here to build, manage and preserve your wealth. Helping the members choose the best plans to invest depending upon their requirements.”

Investment Calculator

About The Company

MAHARANA CAPITAL SERVICES PRIVATE LIMITED was incorporated and declared by the Central Government of India in the Year of 2023, controlled and regulated by the Ministry of Corporate Affairs, Govt. of India.

Further, MAHARANA CAPITAL SERVICES PRIVATE LIMITED is in compliance with all statutory requirements and regulations issued by Ministry of Corporate Affairs, Govt. of India. We have all required documents and certificates to run this company. Company that is working with great enthusiasm and dedication towards providing the best financial platform to its members or shareholders.

Every individual investor will get a unique ID. By this unique ID and personalised password he/she can monitor all the information of his/her account portfolio on company website. The company website is fully secure and updated

INVESTMENT SCHEMES

Features Of Monthly Income Schemes

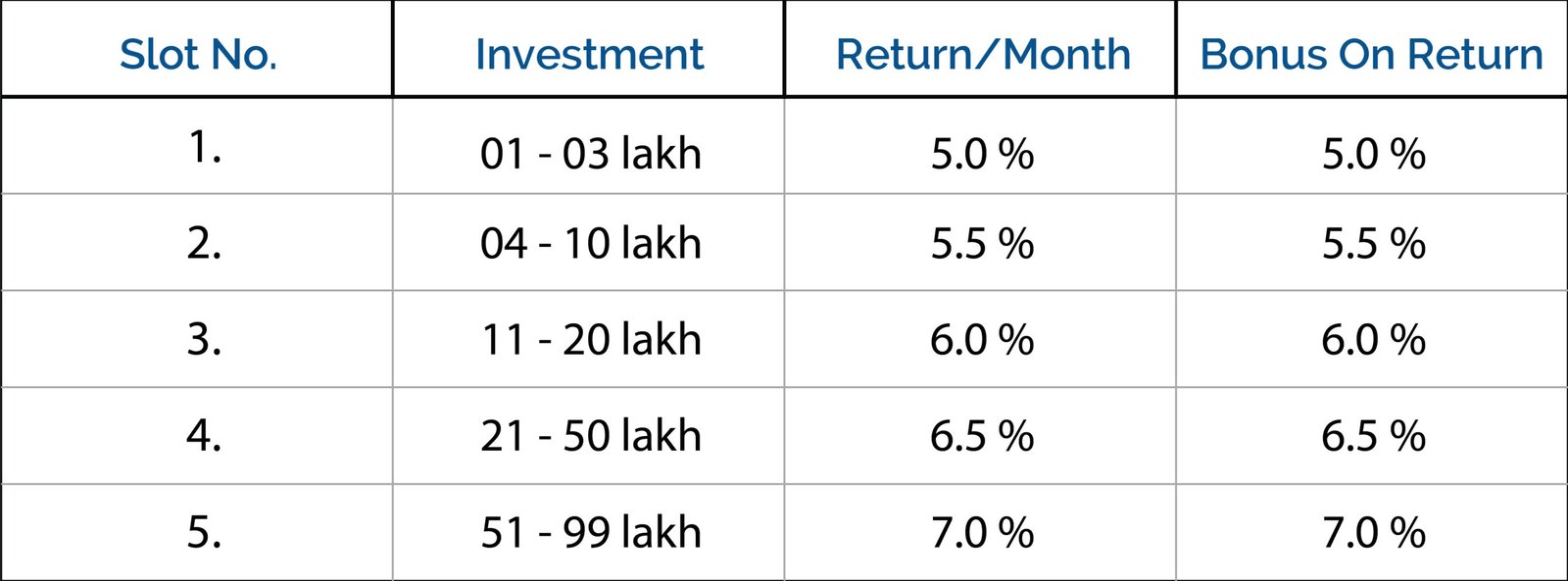

Monthly Income Scheme is introduced by company which is a period of time from minimum 01 year to maximum 10 year at competitive rate of interest and with different features to suites the investment needs of individuals.

In this scheme, members get return on their investments on monthly basis. The investor also get bonuses.

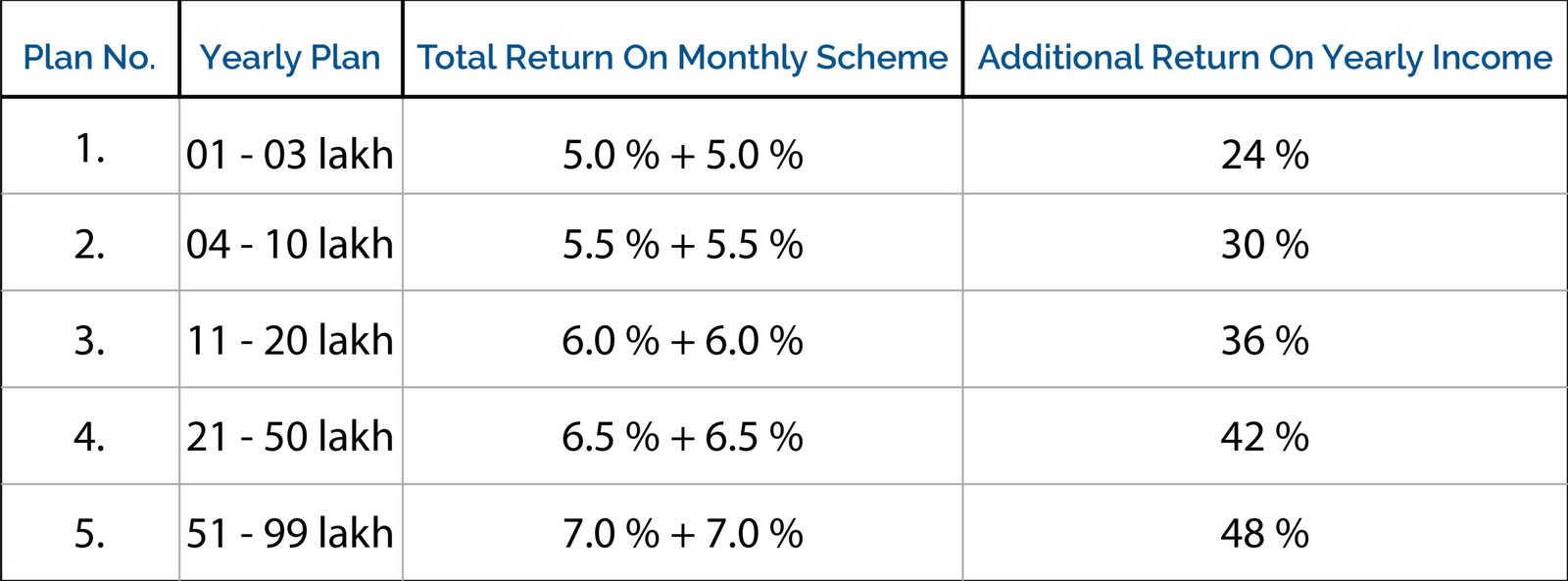

Features Of Yearly Income Schemes

Yearly Income Scheme is a financial instrument where a member gets assured ROI yearly basis It is an investment opportunity provided by company with the benefits of higher rate of interest from Monthly Income Scheme. This is also available for Min. 01 year to Max. 10 year investment plans.

In this scheme, members get return on their investments on yearly basis.

Return amount to be paid by the company to its members is calculated here on basis of the above payment slot. The return amount would be given to our members as per investment and each investment would be calculated separately

How to Invest 50 Lakhs for Monthly Income

| Slot No. | Investment | Return | Bonus* | Income/Month | Income/year | 01 yr. Plan | 03 yr. Plan | 05 yr. Plan | 07 yr. Plan | 10 yr. Plan |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. | 01 lakh | 5,000 | 250 | 5,250 | 63,000 | 78,120 | 2,45,700 | 4,28,400 | 6,26,220 | 9,32,400 |

| 2. | 05 lakh | 27,500 | 1,512 | 29,012 | 3,48,144 | 4,31,698 | 13,57,761 | 23,67,379 | 34,60,551 | 51,52,531 |

| 3. | 11 lakh | 66,000 | 3,960 | 69,960 | 8,39,520 | 10,41,005 | 32,74,128 | 57,08,736 | 83,44,829 | 1,24,24,896 |

| 4. | 21 lakh | 1,36,500 | 8,872 | 1,45,372 | 17,44,464 | 21,63,135 | 68,03,409 | 1,18,62,355 | 1,73,39,972 | 2,58,18,067 |

| 5. | 51 lakh | 3,57,000 | 24,990 | 3,81,990 | 45,83,880 | 56,84,011 | 1,78,77,132 | 3,11,70,384 | 4,55,63,767 | 6,78,41,424 |

Investment 01 crore rupees and above will get 8.0% monthly return on investment and 8.0% bonus on Return and the yearly plans would be same for these investment. The above table is showing only return on investment, actual investment is not included in this. When the investor withdraw his/her money and closes his/her account with us, he/she will get above mentioned amount plus his/her invested amount.

Why Choose Us

Terms & Condition

- Investment amount can only be deposited in company’s bank account by any mode of payment.

- An investor can deposit amount in Bank through net banking, UPI transfer, NEFT/RTGS or Cash.

- Investor will get his/her return on bank account only. The bank account details must be shared at the time of investment and opening account with us.

- Minimum amount for investment would be INR 01 lakh and maximum would be as per will.

- Minimum time for investment would be 01 year and maximum time would be 10 years, if withdraw before 01 year he/she won’t get any benefits of any plan. They will receive only what they have invested.

- Investor must appoint a nominee at the time of investment so if any mishappening occurred, the nominee will get all the amount invested with the return on investment. In case nominee is minor, he/she must wait till he/she gets adult and then only get the amount as per investment plan.

- An investor can open multiple account with us and invest different amount with different plans suitable accordingly his/her needs and requirements.

- Investor can change the bank account at any time in which he/she wants to receive money.

- In monthly income scheme investor will get his/her returns in bank account before 5th day of every month. And in yearly income scheme he/she will get all his amount within a month after completing his/her tenure.

- TDS (Tax Deducted at Source) will be deducted at a rate of 10%. If the total income earned on investment for a financial year exceeds Rs.

- 40,000. For senior citizens, 10% TDS is deducted only when the income exceeds Rs. 50,000.

Contact Us

Maharana Capital Services Private Limited

4-E-16, Rangbari, Kota City, Dist. Kota, Rajasthan 324005

Call : 07444066444

Email : contact@maharanacapital.in